What is the difference between PRUbest start and PRUearly start?

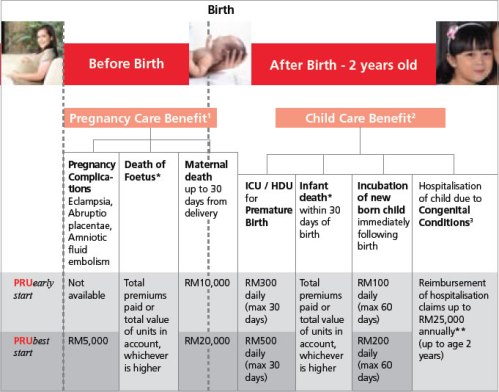

PRUearly start is basic cover for both mother and child during the pregnancy and early infancy period while PRUbest start gives a wider coverage including pregnancy complications.

How does PRUbest start and PRUearly start work?

These benefits cover both the mother and the child even before he/she is born during the crucial pregnancy and ceases when the child is 2 year old. During the pregnancy period up to 30 days from birth of child, the pregnant mother is covered under Pregnancy Care Benefit:

Note: Only 3 types of pregnancy complications are covered in PRUbest start:

(1) Abruptio Placentae (premature separation of the placenta from the womb)

(2) Eclampsia (seizure activity and/or unexplained coma during/after pregnancy)

(3) Amniotic fluid embolism (amniotic fluid entering into mother’s blood circulation)

From the moment the child is born, he/she is immediately covered under Child Care Benefit up to age 2 year old:

Congenital conditions covered under:

PRUearly start

- Anal atresia (absence of the anus opening)

- Congenital Cataract (clouding of the eyes)

- Congenital Deafness (loss of hearing)

PRUbest start

- Infantile Hydrocephalus (head enlargement due to excessive fluid in the brain)

- Anal atresia (absence of the anus opening)

- Congenital Diaphragmatic Hernia (opening of the diaphragm that cause the organs in the abdomen to go up into the chest cavity)

- Atrial Septal Defect (abnormal opening between the heart’s upper left and right chambers. A form of hole in the heart conditions)

- Tetralogy of Fallot (heart conditions with 4 major defects that causes the baby to turn blue due to lack of oxygen)

- Transposition of Great Vessels (switch of position between the heart’s aorta and pulmonary artery. Aorta is rich in oxygen while pulmonary artery is poor in oxygen)

- Truncus Arteriosus (merging of the heart’s aorta and pulmonary artery)

- Ventricular Septal Defect (abnormal opening of the wall between the heart’s left and right lower chamber. A type of hole in the heart conditions)

- Congenital Cataract (clouding of the eyes)

- Congenital Deafness (loss of hearing)

Who is eligible to apply for PRUbest start and PRUearly start?

Any woman age between 18-45 next birthday that is within week 18-35 of her pregnancy. For woman age 18-45 next birthday but ABOVE 35 weeks of pregnancy, they can still secure a policy for their unborn child but PRUearly start and PRUbest start will not be applicable. If death of foetus or death of child occurs within the 30 from birth of child, the higher of total premiums paid or value of units will be paid. However, no coverage will be provided on the mother.

Why is the Congenital Conditions separated into 2 different groups?

PRUbest start provides a more comprehensive protection for the child and this is not only evidenced by the amount of benefit payable but the covered congenital conditions.

What happens when it is a twin pregnancy?

If twin is detected, applicant will be required to purchase to TWO identical policies with same coverage. This is to avoid anti-selection against Company in the event either one of the child is born unhealthy or with complications.

What is the waiting period for PRUbest start and PRUearly start?

These benefits start protecting both the pregnant mother and the growing foetus immediately once the cover commenced after underwriting and premium is paid since there is no waiting period applicable for these 2 benefits.

Can we switch between the 2 benefits or make any changes to the other benefits attached to the policy at a later stage?

Since pregnancy can be rather unpredictable, no switching between PRUbest start and PRUearly start is allowed once the policy is incepted. Also, no changes can be made on the other benefits attached to the policy until the child is born. Any change of benefits after the birth of the child is subjected to underwriting.

What are the documents required during proposal stage?

In addition to the usual documents submitted i.e. proposal form, sales illustration and lifestyle profile, all pre-birth applicants will need to submit a gynaecology report (Form ID: 10201065) completed by their attending gynaecologist. This form can be downloaded from RAISe under New Business Medical Form. In addition to that, a 3D/4D scan will be required if PRUbest start is selected.

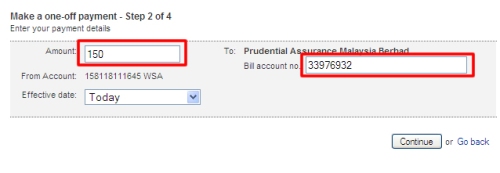

Who will bear the cost of the gynaecology report and 3D/4D scan?

The cost of gynaecology report (up to RM150) will be borne by the Company while the 3D/4D scan shall be at the expense of the applicant.

Upon expiry of PRUbest start/PRUearly start, will the premium be reduced?

Once the benefit expires at age 2, policyholder is free to utilize the premium to further increase their child’s cover or to enhance their investments.

After the child is born, what should the parent do?

The parent should update the child’s details i.e. name of the child, date of birth, gender, birth certificate/MyKid identity card number by providing to the Company of a copy of the birth certificate/MyKid identity card. Without any update on the child’s details, all types of transaction including surrender of the policy will not be allowed.